tax abatement nyc meaning

End Your IRS Tax Problems - Free Consult. This program provides abatements for property taxes for periods of up to 25 years.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

But there can be some drawbacks.

. For example if an owner has a 20-year tax abatement they. Homebuyers can understand the true meaning of the abatement by knowing when it will expire. The Idea to give tax exemption was floated in 1971 to court.

Also available is a list of all NYC Tax Incentive Programs. Pros of 421a Tax Abatements for NYC Home Buyers. Like many you must have wondered what 421a tax abatement is.

To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved. What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be Homebuyers can understand the true meaning of the abatement by knowing when it will expire. Information you may find helpful in filing your.

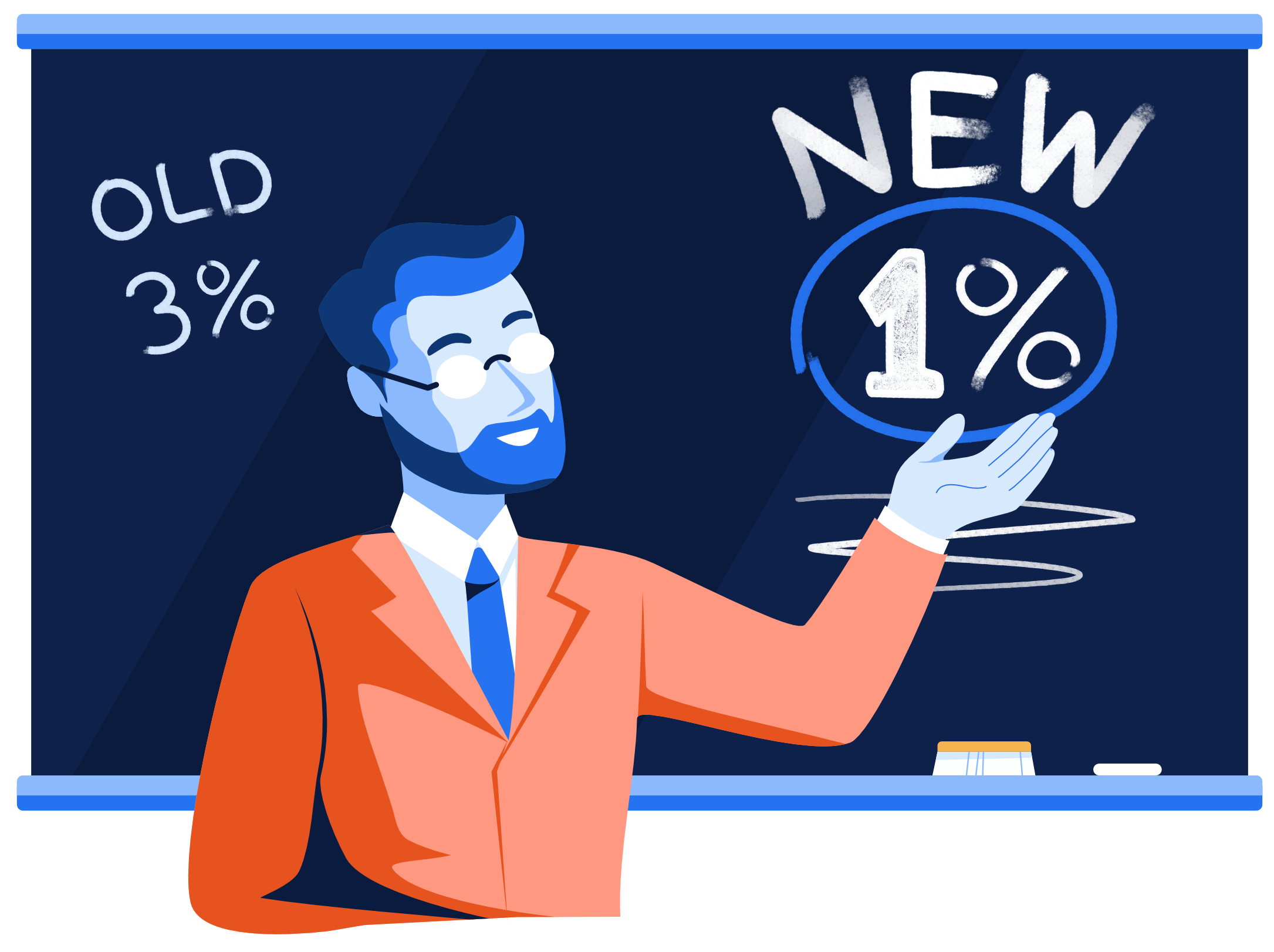

Ad BBB Accredited A Rating. The 10-year abatement provides unit owners with a 100 abatement from property tax increases for the first two years with taxes then being increased by 20 of the current tax rate every two years for. The exemption also applies to buildings that add new residential units.

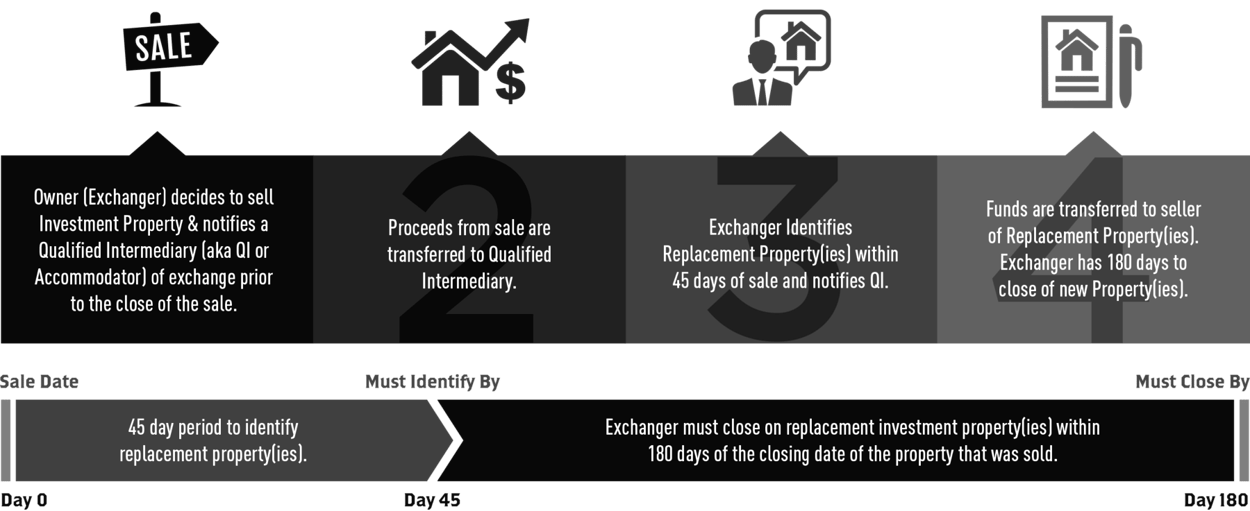

To determine the beginning and end dates for tax benefits given to a building for either of these two programs visit the NYC Department of Finance J-51 Exemption and Abatement and 421-a Exemption webpages. Similar to a 421a the J-51 abatement is to promote the development of multiple-dwelling affordable housing however a J-51. Pros and Cons of 421a Tax Abatements You might think that having lower taxes is just 100 winning.

First of all the J-51 abatement is rare compared to the more famous 421a program. While it may seem a bit tricky to understand at first a. New condominium owners must have filed a real property transfer tax RPTT.

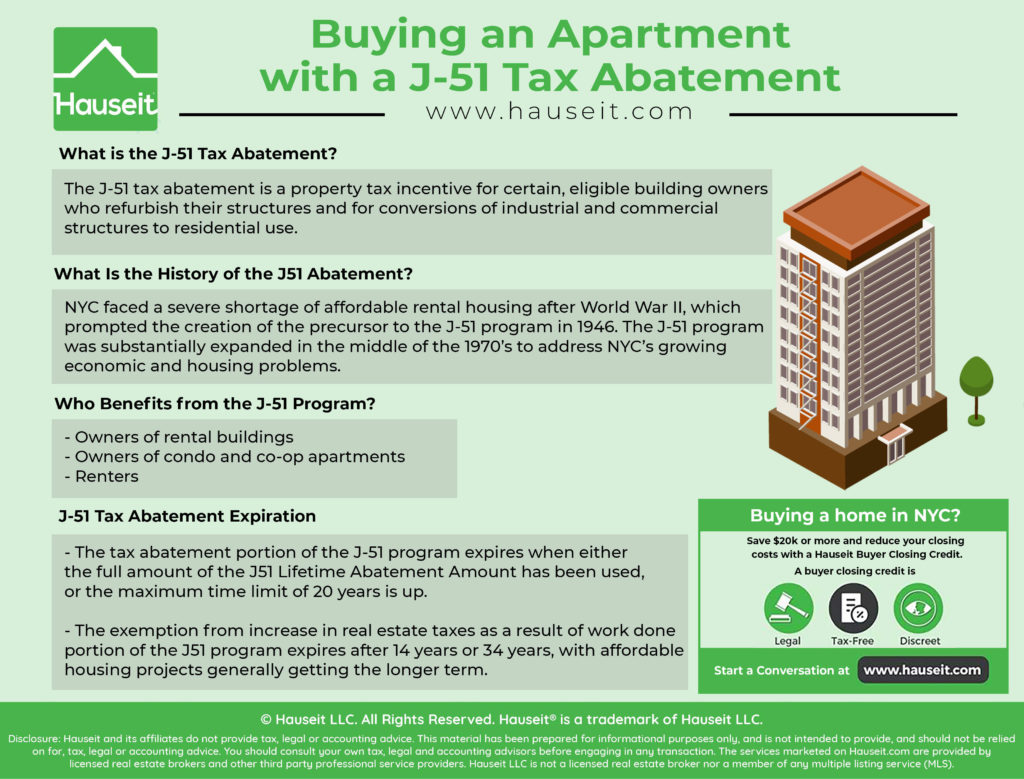

The assessed value is held at the station before the building starts. What Is The 421a Tax Abatement NYC. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction.

The 2022-2023 renewal period has ended. New York City has several tax abatement programs in. The J-51 tax abatement is unique for many reasons.

The 421-a abatement was initially set to run for 10 years but can run for as long as 15-25 years in upper Manhattan and the outer NYC boroughs. A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City. Typically the goal of these programs is to encourage development or renovation of residential properties in specific areas of the city.

It is most commonly granted to property developers in exchange for including affordable housing and the benefit lasts for 10 to 25 years. More details can also be found in HCR Fact Sheet 41. These include the J-51 Program the 421a Program the Senior Citizen Rent Increase Exemption SCRIE the Commercial Revitalization.

New York City has several tax abatement programs in place. Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by February 15 or the following business day if February 15 falls on a weekend or holiday. A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe.

Second the J-51 program is a combination of both a tax exemption and a tax abatement. It also decreases your property tax on a dollar for dollar basis. The 421a tax abatement got its name from the section of New York Real Property Tax Law establishing it.

New York NY 10038. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. Simply put you get a tax break for the duration of the abatement says Golkin.

The J-51 tax abatement rent stabilization consists of a tax exemption that maintains the assessed value before construction begins and a tax abatement that lowers property taxes on a dollar-for-dollar basis. Overall J-51 tax abatements reduce the assessed taxable value of your property while reducing the actual property tax on a dollar to dollar.

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Quick Guide Nyc Real Estate Tax Abatement Czarnowski Beer Llp

A Foot On The Ground And Steps To Fairer Taxes Center For New York City Affairs

How Much Is The Coop Condo Tax Abatement In Nyc

Tax Abatement Nyc Guide 421a J 51 And More

Property Tax Reduction Services New York Mgny Consulting

Buying An Apartment With A J 51 Tax Abatement Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A Tax Abatement Should You Buy A Home With One Localize

Sell Apartment Online Hauseit Sale House Apartments For Sale Apartment

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

What Is The 421g Tax Abatement In Nyc Hauseit

What Is A 421a Tax Abatement In Nyc Streeteasy

Property Tax Reduction Services New York Mgny Consulting

2022 Property Taxes By State Report Propertyshark

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How Much Is The Coop Condo Tax Abatement In Nyc

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube